.webp&w=1600&q=75)

Smart Money, Smart Conversions: Currency and Tax Conversion Tools for Personal Finance

Intelligent Financial Conversions

Tools for currency exchange, tax calculations, and investment analysis

In today's interconnected global economy, financial literacy extends far beyond basic budgeting skills. Smart money management requires mastery of various unit conversions—from currency exchange rates and tax calculations to investment metrics and international transaction costs. Whether you're planning overseas travel, managing international investments, calculating tax obligations across different jurisdictions, or optimizing your personal budget, accurate financial conversions serve as the foundation for informed monetary decisions.

Global Financial Conversion Statistics 2025

Currency Conversion Mastery for Global Finance

Currency conversion forms the bedrock of international financial literacy, extending beyond simple exchange rate calculations to encompass purchasing power parity, real exchange rates, and cross-currency triangulation. Modern financial management requires understanding not just current exchange rates, but also forward rates, currency volatility, and the impact of economic indicators on currency valuations.

Numerical precision becomes critical when dealing with large financial transactions, where small percentage differences in exchange rates can translate to significant monetary amounts. Understanding the relationship between different currency denominations, from cents and pence to major currency units, ensures accurate international financial planning.

Professional Financial Analysis Tools for Smart Money Management

Wireless Meat Thermometer with 4 Probes, INKBIRD WiFi Meat Thermometer Digital Wireless for Rotisserie Grill Oven,Unlimited Range Dishwasher Waterproof Bluetooth Thermometer for iOS & Android

ThermoPro TP605 Instant Read Meat Thermometer Digital for Cooking, Waterproof Food Thermometer with Backlight & Calibration, Digital Probe Cooking Thermometer for Kitchen, Outdoor Grilling and BBQ

Real-Time Exchange Rate Applications

Modern currency conversion extends beyond static exchange rates to incorporate real-time market data, bid-ask spreads, and transaction costs. When planning international purchases or investments, understanding the true cost of currency conversion includes bank fees, credit card foreign transaction fees, and the spread between buying and selling rates.

Essential Currency Conversion Factors:

- Spot Rate: Current market exchange rate for immediate delivery

- Forward Rate: Exchange rate for future currency delivery (30, 60, 90 days)

- Cross Rate: Exchange rate between two currencies via a third currency (usually USD)

- Real Exchange Rate: Nominal rate adjusted for inflation differentials

- Purchasing Power Parity: Exchange rate based on relative price levels

International investment portfolios require sophisticated currency hedging calculations that involve time-based calculations for option premiums, forward contract pricing, and currency swap arrangements. These financial instruments protect against adverse currency movements while maintaining exposure to international market opportunities.

Advanced Currency Trading and Investment Instruments

Escali AH1 Stainless Steel Oven Safe Meat Thermometer, Extra Large 2.5-inches Dial, Temperature Labeled for Beef, Poultry, Pork, and Veal Silver NSF Certified

ThermoPro TempSpike Plus 600ft Wireless Meat Thermometer with 2 Color-Coded Probes, Bluetooth Meat Thermometer Wireless with LCD-Enhanced Booster for Food Cooking Grill Smoker

Travelers and expatriates benefit from understanding purchasing power conversions that go beyond simple exchange rates to consider local price levels, cost of living adjustments, and regional economic factors. These calculations help make informed decisions about international relocation, travel budgeting, and overseas investment opportunities.

Tax Calculation and Optimization Strategies

.webp&w=1600&q=75)

Multi-Jurisdictional Tax Calculations

Tax calculation complexity multiplies exponentially when dealing with multiple tax jurisdictions, different tax years, and various income types. Understanding how to convert between different tax rate structures—from progressive income taxes to flat capital gains taxes—enables optimal tax planning and compliance across different regions and countries.

Proportional calculations become essential when allocating income, deductions, and credits across different tax jurisdictions. Foreign tax credit calculations, for example, require precise conversion between different currency amounts and tax rate structures to avoid double taxation while maximizing allowable credits.

Smart Tax Planning and Optimization Tools

95kPa Vacuum Sealer Machine with AquaLock Technology, for Moist Seals, 2X Seal & 130W, Fully Automatic Food Sealer, Built-In Cutter, Bag Storage & Hose, Precision Sealing, 2 Bag Rolls,Stainless Steel

Tax Conversion Examples and Calculations:

Income Tax Brackets:

- • US Federal: 10%, 12%, 22%, 24%, 32%, 35%, 37%

- • UK Income Tax: 20%, 40%, 45%

- • German Income Tax: 14% - 42% progressive

- • Effective vs. Marginal rate calculations

International Tax Planning:

- • Foreign Earned Income Exclusion: $120,000 (2023)

- • Foreign Tax Credit calculations

- • Treaty shopping optimization

- • Transfer pricing conversions

Business and Investment Tax Conversions

Business taxation involves complex unit conversions for depreciation schedules, inventory valuation methods, and international transfer pricing. Different countries use varying depreciation methods (straight-line, accelerated, units-of-production), requiring conversion between different calculation methodologies for accurate financial planning and compliance.

Capital gains tax calculations require converting between different holding periods, tax rates, and currency valuations for international investments. Understanding the difference between short-term and long-term capital gains rates, wash sale rules, and like-kind exchange provisions helps optimize investment timing and tax efficiency.

Value-added tax (VAT) and sales tax conversions across different jurisdictions require understanding rate variations, input tax credits, and cross-border transaction rules. Geographic calculations help determine applicable tax rates based on buyer and seller locations, digital service rules, and economic nexus thresholds.

Investment Analysis and Portfolio Management

Risk-Adjusted Return Calculations

Investment analysis requires converting between various performance metrics, risk measurements, and benchmarking standards. Sharpe ratios, alpha calculations, and beta measurements all require precise conversion between different measurement scales and time periods to enable accurate portfolio comparison and optimization.

Performance measurement conversions include annualized returns, compound annual growth rates (CAGR), and time-weighted returns that account for cash flow timing effects. These calculations help investors compare investments with different time horizons, cash flow patterns, and risk profiles.

Investment Analysis and Portfolio Management Tools

-58°F to 2732°F Infrared Thermometer IR Laser Gun 50:1, Digital Temperature Gun/K-Type Probe -4°F~932°F, Humidity Sensor, High-Temp Pyrometer for Kiln, Forge, Furnace, Industrial Use

Etekcity Infrared Thermometer Laser Temperature Gun 774, Meat Food Candy Oven Thermometer for Griddle Accessories, Heat Gun for Cooking Refrigerator Tools, Yellow

Investment Metric Conversions:

- • Simple Return: (Ending Value - Beginning Value) / Beginning Value

- • CAGR: (Ending Value / Beginning Value)^(1/years) - 1

- • Risk-Free Rate: Usually 10-year Treasury bond yield

- • Excess Return: Portfolio Return - Risk-Free Rate

- • Standard Deviation: Volatility measure (annualized)

- • Sharpe Ratio: (Return - Risk-Free Rate) / Standard Deviation

- • Beta: Correlation with market movements (1.0 = market)

- • Value at Risk (VaR): Maximum loss at confidence level

Asset Allocation and Diversification Calculations

Portfolio construction requires converting between different asset weights, correlation coefficients, and rebalancing thresholds. Modern portfolio theory calculations involve converting covariance matrices, efficient frontier calculations, and optimal portfolio weights based on risk tolerance and return objectives.

International diversification adds currency exposure calculations, country risk premiums, and foreign exchange hedging ratios to portfolio analysis. Risk pressure calculations help determine optimal hedging ratios and currency exposure limits for international portfolios.

Alternative investment allocations require converting between different valuation methodologies, liquidity premiums, and correlation assumptions. Real estate, commodities, and private equity investments each use different performance metrics and risk measurements that must be standardized for comprehensive portfolio analysis.

Personal Budgeting and Expense Management

Income and Expense Tracking Across Multiple Systems

Personal financial management requires converting between different income frequencies (hourly, weekly, biweekly, monthly, annual) and expense categorization systems. Understanding how to annualize irregular income, calculate effective tax rates, and compare financial products across different terms enables more effective budgeting and financial planning.

Credit and debt management involves converting between different interest rate types (APR, APY, nominal, effective), payment frequencies, and loan terms. Payment volume calculations help determine optimal debt payoff strategies, refinancing decisions, and credit utilization management.

Personal Finance Management Solutions

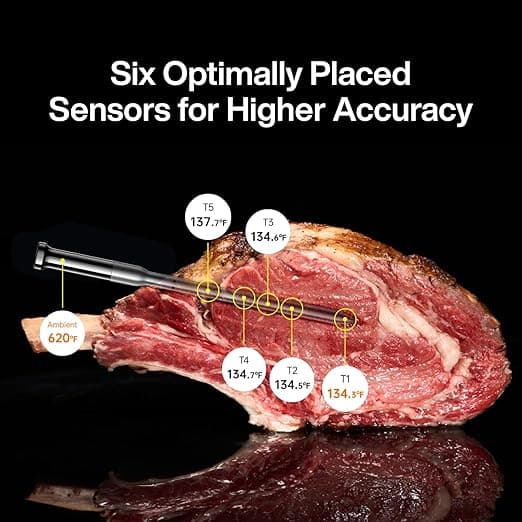

Sync Gold Wireless WiFi Meat Thermometer, 4 Slim Probes, 6 Sensors, 10x Stronger Signal, ±0.5℉ Accuracy, Smart Base Direct Setup, Reliable Reading Through Kamado Grill, BBQ, Oven, Smoker, Air Fryer

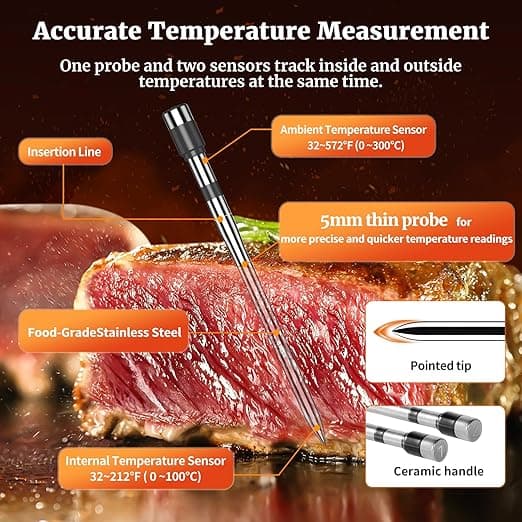

Wireless Meat Thermometer-Multi Sensors Digital Food Thermometer with Ultra-Thin Probes, Accuracy Smart Bluetooth Meat Thermometer for Steak, BBQ, Oven, Grill, Smoker,Recipes in App & Host

Personal Finance Conversion Examples:

Income Conversions:

- • Hourly to Annual: Hours × 52 weeks × 40 hours

- • Gross to Net: After taxes and deductions

- • Biweekly to Monthly: (Biweekly × 26) ÷ 12

- • Freelance to Equivalent W-2: Add self-employment tax

Debt Calculations:

- • APR to Monthly Rate: APR ÷ 12

- • Credit Utilization: Balance ÷ Credit Limit

- • Debt-to-Income: Total Debt ÷ Gross Income

- • Payoff Time: Log calculations with compound interest

Savings and Investment Goal Planning

Financial goal planning requires converting between present and future values, different compounding frequencies, and various investment scenarios. Time value of money calculations help determine required savings rates, investment returns, and time horizons for achieving specific financial objectives.

Retirement planning involves complex calculations converting between different account types (401k, IRA, Roth), contribution limits, and withdrawal strategies. Understanding required minimum distributions (RMDs), tax-deferred vs. tax-free growth, and Social Security benefit optimization requires precise financial conversions across multiple time periods.

Emergency fund calculations require converting between different expense categories, income replacement ratios, and liquidity requirements. Cash flow analysis helps determine appropriate emergency fund sizes, funding strategies, and optimal account structures for maximum accessibility and growth.

Risk Management and Insurance Calculations

Insurance Coverage and Premium Calculations

Insurance planning requires converting between different coverage amounts, deductibles, and premium structures across various insurance types. Life insurance needs analysis involves calculating income replacement ratios, debt payoff requirements, and future expense obligations to determine appropriate coverage levels.

Health insurance optimization involves understanding deductibles, copayments, coinsurance, and out-of-pocket maximums across different plan options. Converting between different plan structures (HMO, PPO, HDHP) requires analyzing premium costs, network restrictions, and potential medical expenses to determine optimal coverage.

Estate Planning and Wealth Transfer Calculations

Estate planning involves complex tax calculations across different wealth transfer methods, including gift tax exclusions, estate tax exemptions, and generation-skipping transfer tax implications. Timeline calculations help optimize wealth transfer strategies across different time horizons and tax environments.

Trust and estate administration requires converting between different valuation methods, discount rates, and tax obligations across multiple beneficiaries and time periods. These calculations ensure optimal wealth preservation and transfer while minimizing tax obligations and administrative complexity.

Technology Integration and Financial Automation

Fintech Integration and API Conversions

Modern financial management increasingly relies on API integrations that require converting between different data formats, currency representations, and financial metrics. Banking APIs, investment platforms, and financial planning tools each use different unit systems and calculation methodologies that must be harmonized for comprehensive financial analysis.

Cryptocurrency integration adds additional complexity with conversion between traditional currencies, digital assets, and various blockchain networks. Understanding transaction fees, network congestion effects, and cross-chain conversion rates enables more effective digital asset management and portfolio optimization.

Essential Financial Conversion Tools:

Currency & Exchange:

- • Number converter for precision rates

- • Time calculator for market hours

- • Proportion tool for allocations

- • Exchange rate historical analysis

Investment & Analysis:

- • Performance metrics calculation

- • Risk assessment tools

- • Cash flow analysis

- • Geographic tax calculations

Artificial Intelligence and Machine Learning Applications

AI-powered financial analysis increasingly handles complex conversion calculations automatically, including real-time currency hedging, tax optimization across multiple jurisdictions, and dynamic portfolio rebalancing. Machine learning algorithms analyze spending patterns, investment performance, and tax implications to suggest optimal financial strategies.

Predictive financial modeling uses historical conversion data to forecast currency movements, tax law changes, and investment performance. These systems help individuals and financial advisors make more informed decisions about asset allocation, tax planning, and financial goal achievement.

Robo-advisors and automated financial planning platforms rely on sophisticated conversion algorithms to provide personalized financial advice, automatic rebalancing, and tax-loss harvesting across diverse investment portfolios and client objectives.

Advanced Financial Technology Solutions for Modern Money Management

ThermoPro TP510 Waterproof Digital Candy Thermometer with Pot Clip, 10 Inch Long Probe Instant Read Food Cooking Meat Thermometer for Grilling Smoker BBQ Deep Fry Oil Thermometer

Candy Thermometer with Pot Clip - Deep Fry Oil Thermometer for Frying and Candle Making

Building Your Personal Financial Conversion System

Integration Strategies and Best Practices

Creating an effective personal financial conversion system requires establishing consistent calculation methodologies, data sources, and update frequencies across all financial planning activities. Start by standardizing currency conversions, tax calculation methods, and investment performance metrics to ensure accurate financial analysis and decision-making.

Data accuracy depends on using reliable financial data sources, understanding calculation limitations, and regularly updating conversion factors for currency rates, tax rules, and market conditions. Establish systematic review processes to verify calculation accuracy and adjust methodologies as financial circumstances and regulations change.

Professional Financial Planning Integration

Effective collaboration with financial advisors, tax professionals, and estate planning attorneys requires understanding common financial conversion standards and calculation methodologies used in professional financial planning. Maintaining financial records in standardized formats facilitates better professional communication and more effective financial advice.

International financial planning requires coordination across multiple professional disciplines, tax jurisdictions, and regulatory environments. Understanding conversion requirements for different professional relationships helps ensure consistent financial strategy implementation and compliance across all relevant jurisdictions.

.webp&w=1600&q=75)

Conclusion: Mastering Financial Conversions for Wealth Optimization

The journey from basic currency conversion to sophisticated financial analysis represents the evolution from reactive money management to proactive wealth optimization. In 2025, financial success increasingly depends on understanding complex conversion relationships between currencies, tax systems, investment metrics, and international financial regulations.

Smart money management through accurate financial conversions empowers individuals to maximize investment returns, minimize tax obligations, and optimize financial strategies across multiple jurisdictions and asset classes. From currency hedging to tax planning, from investment analysis to estate planning, precision in financial conversions translates directly to improved financial outcomes.

The future of personal finance lies in intelligent automation of complex financial conversions, AI-powered optimization of tax and investment strategies, and seamless integration of global financial systems. Begin your journey toward financial conversion mastery today with our comprehensive numerical precision tools and discover how accurate calculations can transform your wealth-building potential.

Optimize Your Financial Conversions

Transform your money management with precision financial conversion tools. Our comprehensive calculators help you optimize currency exchange, tax planning, and investment analysis with professional accuracy.